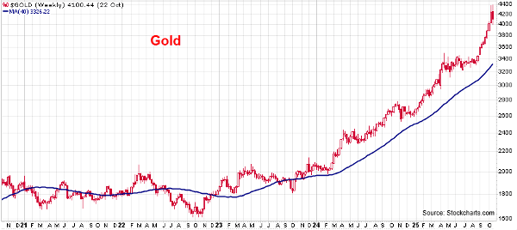

Recently, gold has certainly found its glitter. Over the past twelve months, the S&P 500 is up an impressive 19%, but gold – which has been a holding in many of Measured Wealth’s models for at least the past three years – is up 45%. In fact, from the start of 2022, gold had been closely tracking the returns of the S&P 500, but at the start of this year, gold took off, soaring by 65% YTD through October 20th compared to “just” a 15% return for the S&P 500.

What is driving the price of gold higher? That’s a question many people are asking, but few, if any, have a definitive answer. When it comes to gold, there’s a myriad of factors that could be affecting the metal’s price at any point in time, and it can be difficult to discern which factor specifically is having the most influence.

Possible reasons for gold’s rise include:

- Global central banks (esp. China and Russia) have been buying gold in droves, increasing their reserves.

- Inflation has remained doggedly persistent.

- Geopolitical tensions remain very elevated.

- The US dollar (USD) is down -10% YTD, with a declining USD serving as a tailwind for most commodities (like gold).

- Interest rates are lower this year and the Fed has indicated there will likely be additional cuts in the near future — making non-dividend-yielding assets like gold more attractive.

- The federal deficit is worsening, increasing anxiety about US fiscal stability and further fueling the increased appetite for gold.

Again, propelling the price of gold higher could involve all of the above bullets, or just one or two. No one knows for sure how many are having an actual impact.

And making gold even more perplexing is unlike a stock, gold has no underlying fundamentals, such as earnings or profit margins or return on equity. That said there’s no explicit method for valuing the price of gold, as compared to equities which can be valued a number of different ways (P/E, P/BV, P/CF, enterprise value, etc.).

Ultimately, what arguably most influences the trading of gold is investor psychology or market sentiment. When investors are fearful and uncertain -- whether it’s due to very elevated equity valuations, economic recession risk or escalating geopolitical threats, to name just a few, they often seek the perceived safety of gold.

As already mentioned, given that gold does not have a P/E ratio and can’t be valued using conventional valuation metrics, it makes the trading of gold prone to bubbles. The value of gold is what investors believe it should be at any point in time. For gold to rise in price, investors believe that allocating their investment funds in the metal is the better alternative relative to other investment options. It’s a conscious choice to forgo other opportunities and instead park it in gold. In effect, even central banks are making this conscious choice, deliberately buying gold as a means of diversifying away from other asset classes.

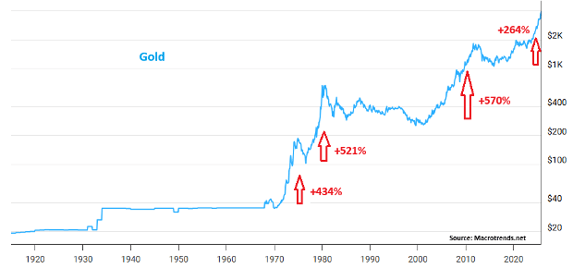

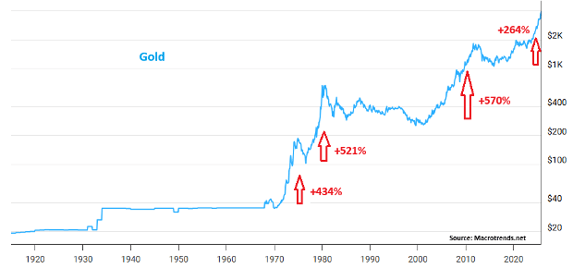

With gold having little “intrinsic value” and yet possessing perceived value driven by investor psychology, the price of gold can often go on multi-year runs before finally peaking. The following chart shows the price of gold dating back to 1910.

Note that before the US fully left the gold standard in 1971, the price of gold was set by governments and central banks, explaining the decades of when the price of gold was more or less flat. But after President Nixon delinked the US dollar from gold in 1971, gold freely traded, allowing market forces to determine its price.

No longer fixed, the price of gold has enjoyed periods of rapid appreciation. I included in the above chart price return percentages (in red) for three extended rallies in gold before a meaningful correction. The average return for those three rallies is +508%. Compare this figure to the current advance in gold, which so far is up +264% -- or about half the return generated in the prior three extended rallies. Bottom line: while the recent rise in gold prices may appear significant, it reflects how investors have historically turned to gold during periods of market uncertainty. Future movements, however, will depend on a variety of economic and market factors that cannot be predicted.

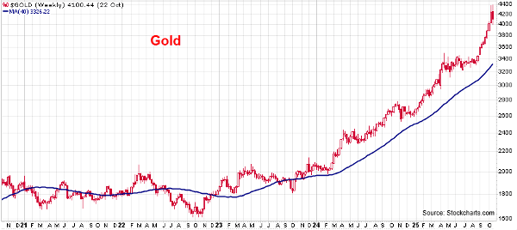

Note that when gold significantly deviates from its longer-term moving average (dark blue line), it tends to pullback and consolidate, closing the wide gap. Serving as a catalyst for this consolidation could be a rally in the US dollar, which itself is trading at very oversold levels. But as long as gold remains above its 200-day moving average, and the moving average itself remains upward-sloping, the metal can be considered to be in a well-defined bull market.

If you have any questions, please feel free to call or email.

The entire team at Measured Wealth wishes to thank you for entrusting us to deliver on your financial goals.

Edward Miller, CFA, CMT

Chief Investment Officer

Measured Wealth Private Client Group

Important Disclosures

Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns citied above are from various sources including Factset, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y-Charts, Inc. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

In order to provide effective management of your account, it is important that we have current information regarding your financial status and circumstances. Please contact us in writing at 303 Islington Street, Portsmouth, NH 03801 if you have any changes in your financial situation or investment objectives, and whether you wish to impose any reasonable restrictions on the management of the account or reasonably modify existing restrictions.

Measured Wealth Private Client Group, LLC is an investment adviser located in Portsmouth, New Hampshire. Measured Wealth Private Client Group, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Measured Wealth Private Client Group, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.

This publication is provided to clients and prospective clients of Measured Wealth Private Client Group, LLC for general informational and educational purposes only. It does not: (i) consider any person's individual needs, objectives, or circumstances; (ii) contain a recommendation, offer, or solicitation to buy or sell securities, or to enter into an agreement for investment advisory services; or (iii) constitute investment advice on which any person should or may rely. Past performance is no indication of future investment results. This publication is based on information obtained from third parties. While Measured Wealth Private Client Group, LLC seeks information from sources it believes to be reliable, Measured Wealth Private Client Group, LLC has not verified, and cannot guarantee the accuracy, timeliness, or completeness, of the third-party information used in preparing this publication. The third-party information and this publication are provided on an “as is” basis without warranty.

This publication may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “should,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio's operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Measured Wealth Private Client Group, LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.