Image courtesy of Carolyn Ann Geason

A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, their severe impact, and the widespread insistence they were obvious in hindsight. Black swan events can cause catastrophic damage to an economy because they cannot be predicted. Reliance on standard forecasting tools can both fail to predict and potentially increase vulnerability to black swans by propagating risk and offering a false sense of security.

Examples of Past Black Swan Events:

- The financial crash of the U.S. housing market during the 2008 crisis is one of the most recent and well-known black swan events. The effect of the crash was catastrophic and global, and only a few outliers were able to predict it happening.

- The dot-com bubble of 2001 is another black swan event that has similarities to the 2008 financial crisis. America was enjoying rapid economic growth and increases in private wealth before the economy catastrophically collapsed. Since the Internet was at its infancy in terms of commercial use, various investment funds were investing in technology companies with inflated valuations and no market traction. When these companies folded, the funds were hit hard, and the downside risk was passed on to the investors. The digital frontier was new and nearly impossible to predict the collapse.

- As another example, the previously successful hedge fund, Long-Term Capital Management (LTCM), was driven into the ground in 1998 as a result of the ripple effect caused by the Russian government's debt default, something the company's computer models could not have predicted.

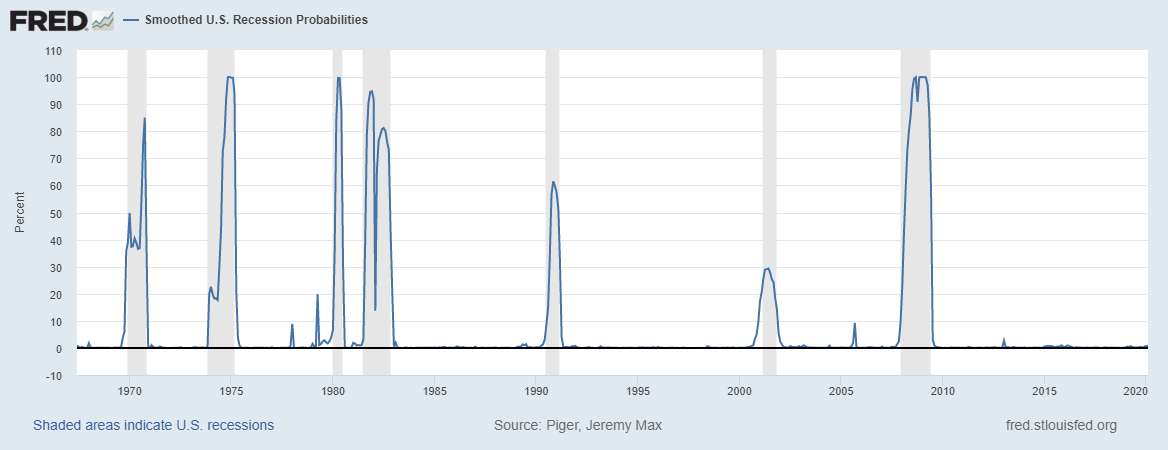

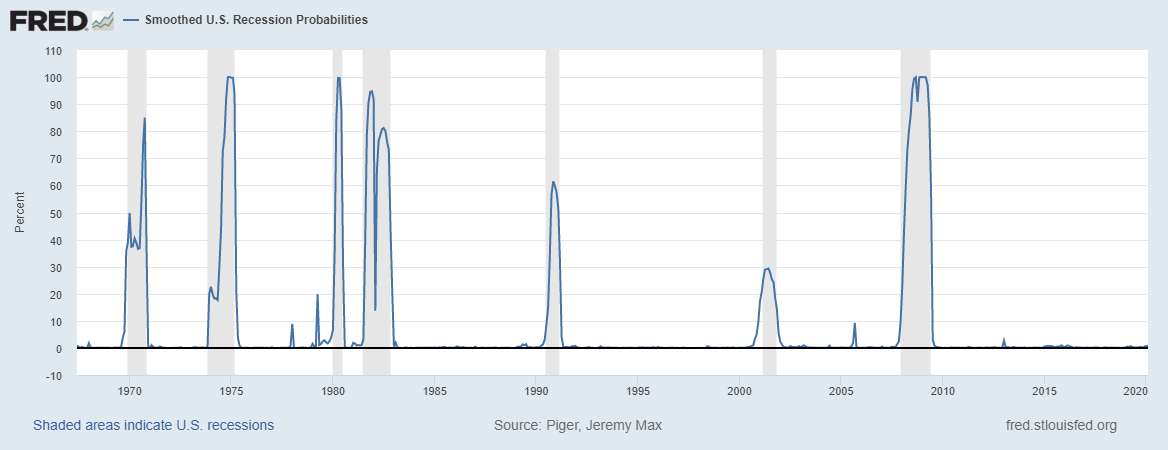

Is COVID-19 a Black Swan Event? We believe it is - as of the end of February 2020, the St. Louis Federal Reserve put the probability of a US recession at less than 1.0%.

Recession Probabilities

June 1967 - February 2020

Source: Piger, Jeremy Max and Chauvet, Marcelle, Smoothed U.S. Recession Probabilities, Federal Reserve Bank of St. Louis.

What About Diversification?

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting exposure to any single risk. The rationale behind this technique is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk.

Diversification strives to smooth out risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others.

The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated—that is, they respond differently, often in opposing ways, to market or economic influences.

Unfortunately, during Black Swan events, correlations tend to be nearly perfectly correlated which is what happened during the first quarter with nearly all assets classes and geographies posing negative returns. The S & P 500 was down 20% for the quarter which masks the true extent of damage with sectors such as Energy down 50% and asset classes such as International equities down 26% and Small Cap Value stocks down 35%. The fixed income markets suffered as well with US Investment Grade Corporates down 3% and Emerging Market debt down 15%. Only traditional safe havens such as US Treasuries and Gold were able to produce positive returns during the quarter.

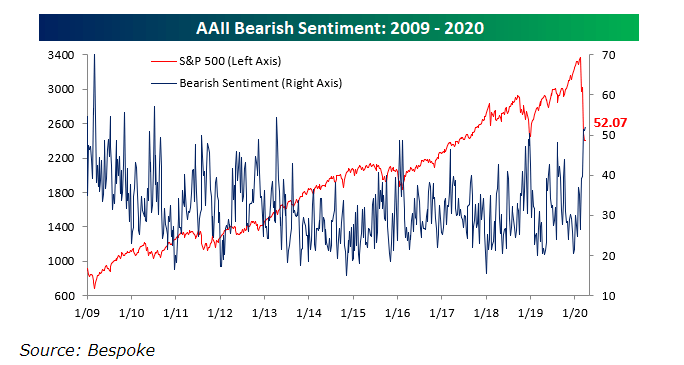

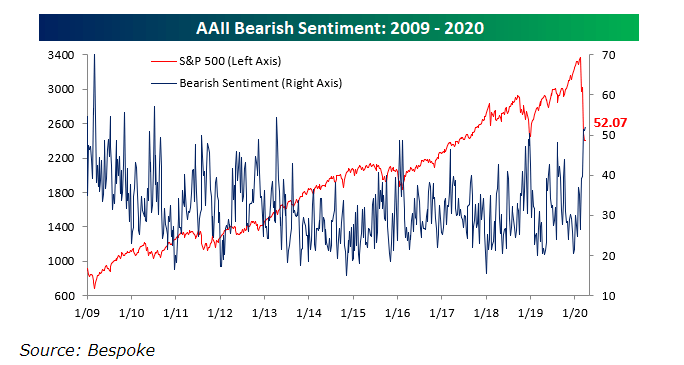

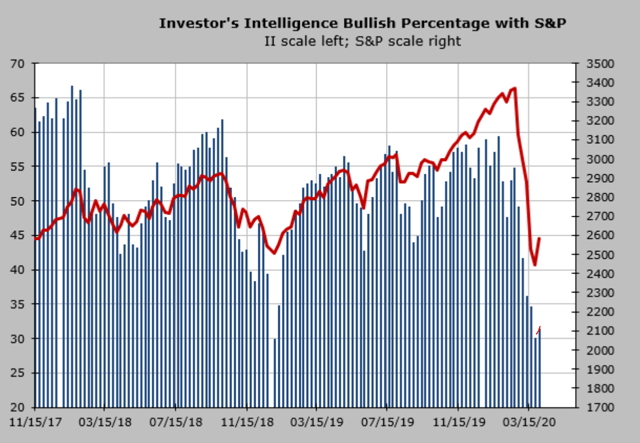

So, after a quarter of unprecedented volatility – where are we today? The current state of investor attitudes would suggest that we are closer to a bottom than most people think. While the market indices are notably off their worst levels seen in the middle of March, the small investor remains negative, reaching levels which have marked major bottoms in the past.

Source: Investor's Newsletter Survey

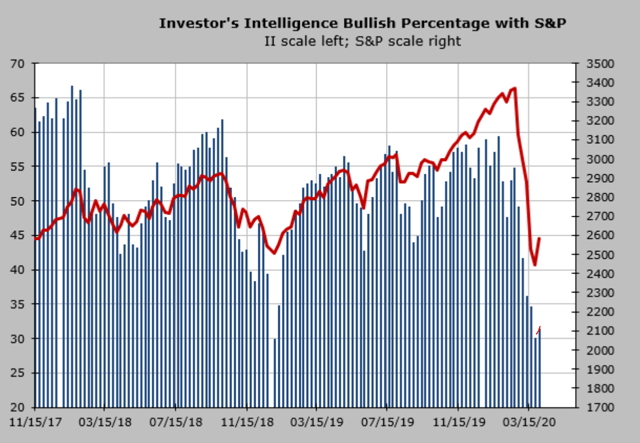

Hedge funds are showing similar levels of concern with a record under allocation to equities currently when compared to the last decade – which provides significant future buying power:

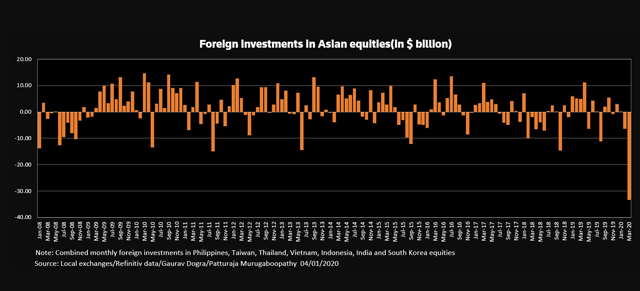

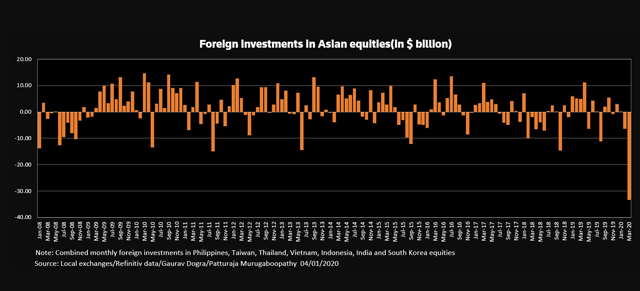

Fear has gone global and is not just confined to the developed markets. Investors pulled out more than three times the money from emerging markets during Q1 2020 than they did in any one month during the global financial crisis:

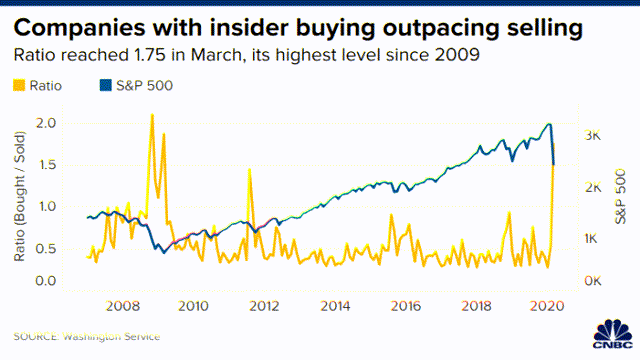

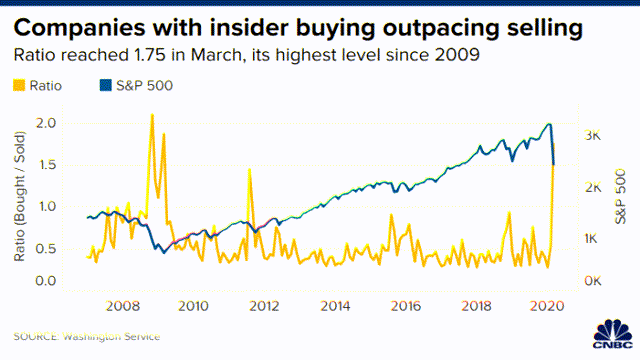

Yet, not everyone is bearish – corporate insiders are buying their company’s stocks at levels not seen since the 2008-2009 Financial Crisis.

Insiders can be early, but they know the impact on their company's activity and clearly, they are not seeing cause for alarm that everyone else is. They also have a better gauge on the pulse of the economy and possible changes to lockdown scenarios by the administration. Their unbridled bullishness is possibly one indicator that suggests the bottom might be in or we won't go much lower than the March lows.

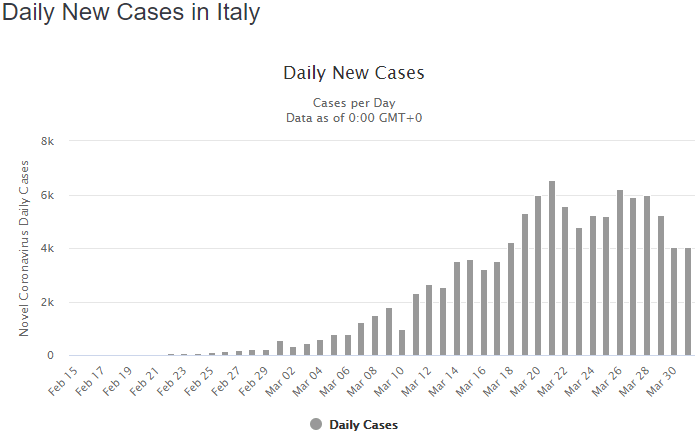

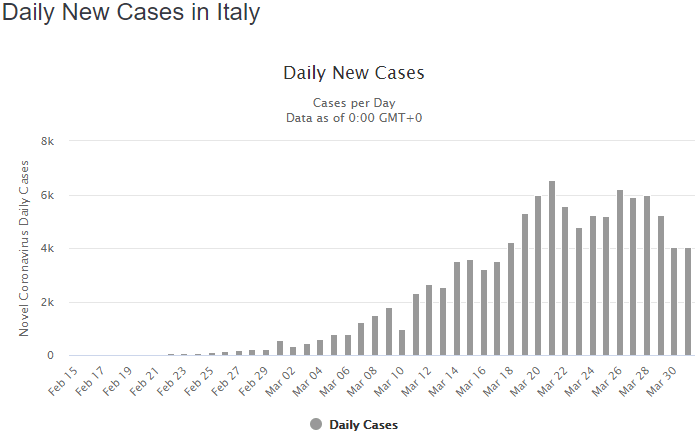

What are we watching? Of course, from an investing standpoint people are wondering as to how long the measures limiting economic activity will stay in place. JPMorgan (JPM) last month, predicted a peak in Italian COVID-19 cases in the week of March 18-March 25. That peak came right on schedule on March 21. Equally important, the rate of growth of COVID-19 cases has fallen rather markedly when computed as a percentage of total cases.

Source: Worldometer

On March 14, a few days after the lockdown in Italy, total known cases were growing at almost 20% a day. Today that number is close to 4% and continues to fall. Now this is to some extent a law of large numbers at play, but it also portrays the difficulty the virus has of transmitting once the population takes countermeasures.

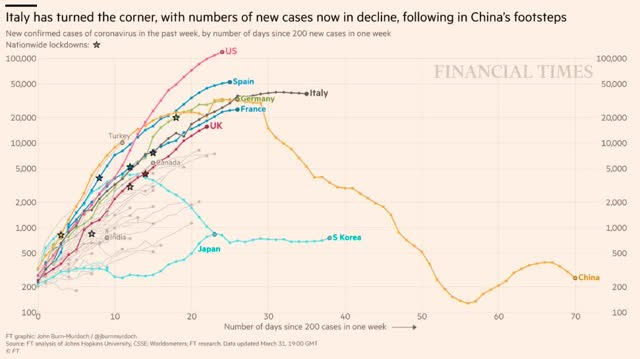

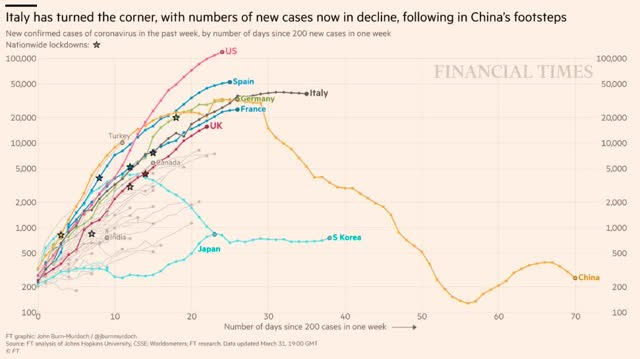

When looked at globally, the following graphic tells the story (and no, I don’t believe the numbers out of China either):

We certainly have a giant consensus that the virus will take a long time to resolve and financial markets are unlikely to recover for the foreseeable future. Corporate insiders appear to be a tiny group that is dissenting. Based on that, we could put in a final bottom sometime over the next few months before markets recover. There are quite a few unknowns at present and markets hate uncertainty. That being said, no one is going to send out an email giving investors the “all-clear” signal. This market has shown it is just as willing to appreciate by 10% a day as it is to decline 10% when looking at the daily performance of the S & P 500. Missing out on the best days in the market have been shown time and time again to be hazardous to your wealth.

Source: Putnam Investments

One of the first things I was taught as a “young investor” over 30 years ago was that the market over-discounts known negatives or as veteran investor Bob Farrell put it:

“When all the experts and forecasts agree — something else is going to happen.”

We at Measured Wealth hope you and your family remain healthy through this trying time for all. Please call or email if you have any questions.

Steve Bruno, CFA

Chief Investment Officer

April 7, 2020

Disclaimer: Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns citied above are from various sources including Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y Charts, Inc.