Before reviewing the 1Q, I’d like to discuss the tariffs announcement that occurred after the quarter-end. On April 2, President Trump declared a 10% baseline tariff on all countries, with higher rates applied for about a dozen countries that ran trade surpluses with the United States. Equity markets around the world plunged on this news as investors did not anticipate any announced tariffs being this steep. The growing fear is that our larger trading partners will retaliate by raising or imposing new tariffs on the US, which could fuel an escalating trade war. The Wall Street Journal commented, “The plan represents a fundamental rethinking of US trade policy on a scale not seen since the post-World War II era.”

The following chart puts into historical perspective the level of these recently announced tariffs:

As shown in the chart, the announced tariffs are the highest in over 100 years, even higher than the Smoot-Hawley tariffs of 1930, which most economists argue further exacerbated the Great Depression of 1929. Such aggressive tariffs tend to adversely shock the economy as consumers bear the brunt of the pain in the form of higher prices. For example, the Federal Reserve Bank of New York found that Trump’s first-term tariffs cost US consumers $1.4 billion monthly, as “the entire incidence of the tariffs fell on domestic consumers.” In other words, companies that pay the tariffs pass on the higher costs to consumers by raising prices. In effect, tariffs are inflationary and also serve as a very regressive tax. Trump’s administration claims the tariff levies will bring in $6 trillion in revenue, which would translate into the biggest tax hike in US history.

What does all of this mean for markets and investments? Good question! In trying to anticipate what could happen down the road, a major unknown is President Trump could decide to negotiate these tariffs lower or even cancel them entirely.

But assuming the tariffs stay in place as is, the Fed faces what could become a perplexing predicament. On the one hand, tariffs are inflationary, and normally, the Fed combats rising prices by raising rates. However, inflation caused by tariffs is different than the more typical inflation that results from a strong economy and rising wages. With the latter, the Fed’s raising of rates cools down or slows the economy so that inflation soon tempers and heads south. But raising rates will not “cool down” tariffs. Unfortunately, a more likely outcome with high tariffs is an economic recession, the result of consumers buying less due to the higher prices. During recessions, the Fed typically cuts rates to stimulate growth, but in this instance such a move could have unintended consequences, such as possibly further fueling inflation in certain areas of the economy. For the record, Fed Chair Jerome Powell recently commented, “It is too soon to say what will be the appropriate path for monetary policy.”

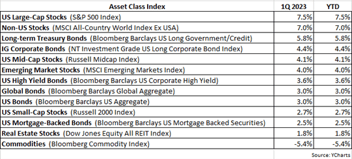

Before returning to this topic of tariffs, it may be a suitable time to discuss investment returns in the 1Q. As shown in the table at the start of this letter, US stocks fared the worst in the quarter. The S&P 500 was down -4.3%, mid-cap stocks were down -3.4% and the Russell 2000 Index (small-caps) declined by -9.5%. Commodities fared the best (led by gold), up 8.9% in the quarter, and non-US stocks rose by 5.4%, thanks primarily to a weakening US dollar. As for fixed-income, most bond categories fared very well, enjoying positive returns in the quarter due to declining interest rates. Finally, it’s worth mentioning that the “Magnificent 7” stocks may have peaked as they were collectively down nearly -16% in the quarter.

Circling back to the subject of tariffs, as I write these words the S&P 500 is now down -12% year-to-date (YTD). On that note, I thought this next chart was interesting:

The chart shows what has happened historically after the S&P 500 has declined by -10%. See a pattern? Because I certainly don’t! After a -10% correction, the S&P 500 has exhibited a wide range of future returns, at the extremes eventually rising higher than 50% or pushing lower to near a -50% decline over the next 12 months.

The fact is every market correction is fairly unique, occurring at different times in the past under a myriad of differing circumstances. The 1998 market correction was short-lived, followed by 25+% gains in less than a year, whereas the 1968 market correction was the opposite, eventually resulting in -25+% losses in less than a year. It’s our job to work within our time-tested process to surmise what lies ahead this year.

As covered in prior investment letters, heading into 2025, the S&P 500 was “priced for perfection” as most valuation measures were either elevated or at historical highs. In addition, the bulk of the gains in the index were heavily concentrated, coming from just a handful of stocks (Magnificent 7). Such conditions left little room for error and any unexpected development or event could serve as the match to light the fire. Like Trump’s tariffs.

But the key point is that the S&P 500 was already in an arguably precarious position before the start of this correction, which conceivably suggests that we’re not out of the woods yet. Although valuations have improved recently as has the concentration of returns within the index, given the prior extremely elevated levels for both, it could take some time to work off such excesses.

With respect to client portfolios, we remain defensively positioned as we are always being as mindful and vigilant about preserving capital as we are striving to achieve significant relative performance gains.

If you have any questions, please feel free to call or email.

The entire team at Measured Wealth wishes to thank you for entrusting us to deliver on your financial goals.

Edward Miller, CFA, CMT

Chief Investment Officer

Measured Wealth Private Client Group

Important Disclosures

Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns citied above are from various sources including FactSet, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y-Charts, Inc. The content is developed from sources believed to provide accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

In order to provide effective management of your account, it is important that we have current information regarding your financial status and circumstances. Please contact us in writing at 303 Islington Street, Portsmouth, NH 03801 if you have any changes in your financial situation or investment objectives, and whether you wish to impose any reasonable restrictions on the management of the account or reasonably modify existing restrictions.

Measured Wealth Private Client Group, LLC is an investment adviser located in Portsmouth, New Hampshire. Measured Wealth Private Client Group, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Measured Wealth Private Client Group, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.

This publication is provided to clients and prospective clients of Measured Wealth Private Client Group, LLC for general informational and educational purposes only. It does not: (i) consider any person's individual needs, objectives, or circumstances; (ii) contain a recommendation, offer, or solicitation to buy or sell securities, or to enter into an agreement for investment advisory services; or (iii) constitute investment advice on which any person should or may rely. Past performance is no indication of future investment results. This publication is based on information obtained from third parties. While Measured Wealth Private Client Group, LLC seeks information from sources it believes to be reliable, Measured Wealth Private Client Group, LLC has not verified, and cannot guarantee the accuracy, timeliness, or completeness, of the third-party information used in preparing this publication. The third-party information and this publication are provided on an “as is” basis without warranty.

This publication may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “should,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio's operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Measured Wealth Private Client Group, LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.