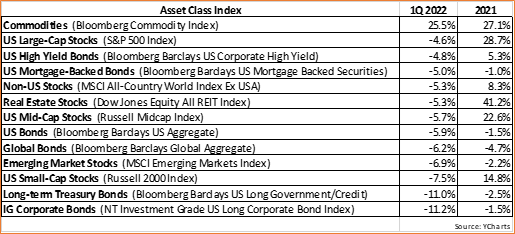

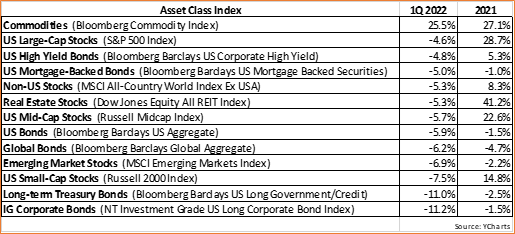

After very good performance in 2021, US equities decidedly struggled in the 1Q of 2022. The S&P 500 followed up last year’s impressive 28.7% total return with a -4.6% decline in the recent 1Q. And it wasn’t just large-cap stocks that suffered in the quarter as both mid-cap and small-cap stocks fell by -5.7% and -7.5% respectively. Frankly, there was seemingly no place to hide to start this year with nearly all major asset classes experiencing negative returns. The standout winners were assets that benefit from higher inflation and not surprisingly commodities were atop that list, with the Bloomberg Commodity Index up an eye-opening 25.5% in the 1Q.

Typically, when equities are having a rough go of it, we can usually count on fixed-income allocations to serve as a ballast for portfolios, helping to offset any resulting drawdowns. Unfortunately, however, bonds also struggled in the quarter as evidenced by the bellwether Barclays US Aggregate Bond Index declining by -5.9%. Other fixed-income vehicles fared even worse as long-term Treasuries dropped -11% and US corporate bonds were off by -11.2% in the quarter. In short, it was the worst quarterly return for US bonds in 40 years.

With both equity and fixed-income asset classes experiencing headwinds so far this year, it begs the question: what’s going on? Good question! Currently, the investment landscape is not very accommodative for either stocks or bonds. The Fed announced months ago that its quantitative easing (QE) program would come to an end and quantitative tightening would commence in the form of several anticipated interest rate hikes. As a result, the 10-year Treasury yield started 2022 at approximately 1.5% and steadily climbed to near 2.4% by the end of March. Such a dramatic rise in interest rates drove most fixed-income prices much lower.

Why is the Fed raising interest rates? Primarily to combat rising inflation. Although at this point it’s almost a distant memory, there was a time when inflation was a non-issue and if anything, a moderate amount of inflation was desired. The Fed had stated that 2% average inflation was their target, with the word “average” being a new term for the Fed when it came to inflation. They no longer would raise rates once inflation first rose above 2%, but rather only after it averaged 2% or more for an extended period. The most recent annual inflation rate is 8.5% and the rolling 12-month average has been well above 2% since the second half of last year, so action by the Fed was in order.

Based on Fed Funds futures as well as consensus opinion, the Fed is expected to raise interest rates several times during 2022-2023, with the upper-range estimate being 11 hikes. An outcome of the Fed raising rates is the economy tends to slow down and even risks entering a recession. The proverbial “soft landing” for the economy is always the Fed’s goal but is almost never achieved. Instead, the Fed is typically “behind the curve” with inflation, meaning it’s arguably late in starting rate hikes and as a result goes too far with the number of rate increases, draining precious liquidity from the financial system and eventually pushing the economy into recession.

That said, there’s no guarantee a recession will result from this most recent cycle of Fed rate hikes. In fact, it’s important to point out that economic conditions today differ from past recessionary periods – in many respects, significantly. In prior client letters, we’ve discussed how the pandemic introduced several unprecedented events, from the shutdown of the global economy to the trillions of dollars in stimulus provided by both the Fed and US government. The pandemic effectively squashed demand for products and services by deferring consumer purchases. But once the economy gradually began to reopen, consumer demand surged as if on steroids, in large part due to the injection of massive stimulus. At the same time, supply channels which were shuddered by the pandemic could not keep up with the resurgence of demand and bottlenecks quickly developed. Rising inflation was the net result.

With the Fed halting QE and planning to raise interest rates multiple times over the next several months, in addition to the end of pandemic-related government aid, consumer demand will no longer enjoy the unprecedented tailwinds that came with the stimulus. Excess liquidity will dry up, likely reducing demand, which will help to alleviate and mend supply chain bottlenecks, which will ultimately work to reduce inflation. The main point being the Fed could raise interest rates fewer times than currently expected to achieve the goal of tempering inflation. As the economy slows and hopefully avoids recession, the 8-11 rate hikes currently priced into markets could get revised to perhaps 4-6 hikes or even less. While that still means interest rates head higher, markets move based on existing expectations and with this decline in the number of expected rate hikes, equities and bonds should respond positively to such a bullish change in expectations.

It goes without saying that these are very complicated times, arguably even more complicated than is usually the case. Given everything written above, not mentioned is the horrific invasion of Ukraine, which has further exacerbated inflation with the spike in crude oil prices and has also introduced the once-unfathomable spectre of World War III as another risk for investors to digest. There is a time and a place for making outsized portfolio exposures, but we believe now is clearly not that time. It’s never prudent to make big bets just for the sake of making big bets. Based on our research and analysis, more than a few key macro developments are currently in flux or at a crossroads and depending on how one breaks would likely affect all others in domino fashion. Although our stance has been generally defensive since late last year, at this point we prefer to take a wait-and-see approach before establishing more aggressive portfolio exposures.

The team at Measured Wealth wishes you all the best during the rest of 2022. As always, if you have any questions, feel free to call or email.

Ed Miller, CFA, CMT

Chief Investment Officer

Measured Wealth Private Client Group

Important Disclosures

Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns citied above are from various sources including Factset, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y-Charts, Inc. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

In order to provide effective management of your account, it is important that we have current information regarding your financial status and circumstances. Please contact us in writing at 303 Islington Street, Portsmouth, NH 03801 if you have any changes in your financial situation or investment objectives, and whether you wish to impose any reasonable restrictions on the management of the account or reasonably modify existing restrictions.

Measured Wealth Private Client Group, LLC is an investment adviser located in Portsmouth, New Hampshire. Measured Wealth Private Client Group, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Measured Wealth Private Client Group, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.

This publication is provided to clients and prospective clients of Measured Wealth Private Client Group, LLC for general informational and educational purposes only. It does not: (i) consider any person's individual needs, objectives, or circumstances; (ii) contain a recommendation, offer, or solicitation to buy or sell securities, or to enter into an agreement for investment advisory services; or (iii) constitute investment advice on which any person should or may rely. Past performance is no indication of future investment results. This publication is based on information obtained from third parties.

While Measured Wealth Private Client Group, LLC seeks information from sources it believes to be reliable, Measured Wealth Private Client Group, LLC has not verified, and cannot guarantee the accuracy, timeliness, or completeness, of the third-party information used in preparing this publication. The third-party information and this publication are provided on an “as is” basis without warranty.

This publication may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “should,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio's operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Measured Wealth Private Client Group, LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.