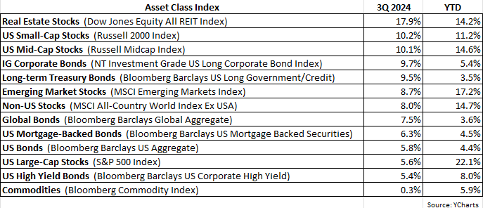

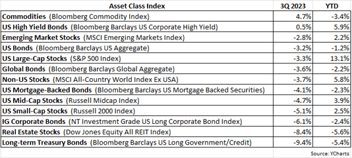

The third quarter finished with something occurring that we haven’t observed in quite some time: smaller cap stocks outperforming their larger cap brethren. While the S&P 500 rose a respectable 5.6% in the 3Q, both the small-cap Russell 2000 Index and the Russell Midcap Index nearly doubled that return, appreciating by 10.2% and 10.1%, respectively. Generally, it’s a bullish sign when smaller cap stocks outperform larger caps since the former far outnumber the latter, meaning the breadth of the market is improving (i.e. a broad number of stocks are participating in the advance, as opposed to a concentrated group of large caps). As we’ve discussed here in the past, since early 2023, the performance of the S&P 500 has increasingly been attributed to just a handful of stocks (the “Magnificent 7”). Perhaps this recent surge in smaller-cap interest by investors indicates a healthy rotation away from a select few mega-caps. And it’s worth mentioning that smaller cap stocks tend to be more economically sensitive, inferring that the economy may have indeed achieved a so-called “soft landing.”

In September, with inflation continuing to subside and indications of the economy slowing, the Fed decided to (finally) cut interest rates by 50 basis points. In response, interest-rate-sensitive sectors like real estate (REITs) and utilities took off in the quarter, as REITs rose by nearly 18% and utilities gained just over 20%. The Fed’s rate cut was not a surprise as the 10-year Treasury yield declined from its 2024 peak of 4.7% in late April to 3.8% by the end of the 3Q. Also faring well in the quarter were higher-duration-sensitive fixed income investments, such as corporate bonds and long-term Treasuries, both rising by nearly 10%. The worst performing asset class in the quarter was commodities, primarily due to waning inflation, easing of economic growth and arguably an oversupply of crude oil.

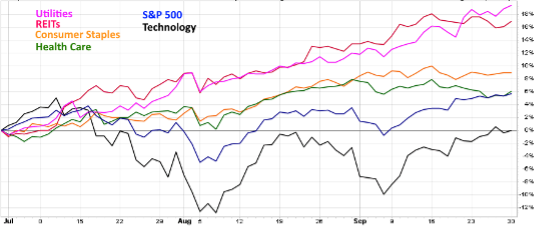

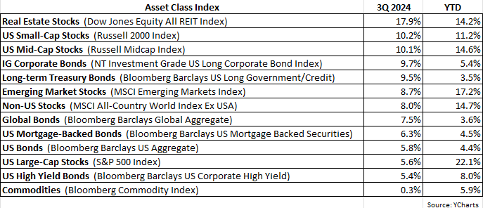

Despite smaller caps exhibiting renewed life this past quarter, further fueling already-elevated bullish market sentiment, several bearish developments unfortunately remain in place which should give one pause. For example, as shown in the following chart, during the quarter, defensive or risk-off sectors (utilities, REITs, health care, consumer staples) outperformed the S&P 500, while technology, the best performing sector since the COVID market bottom in 2020, was flat.

Typically defensive sectors do not lead the way in a bull market, and often such an occurrence is foreboding for troubling times ahead.

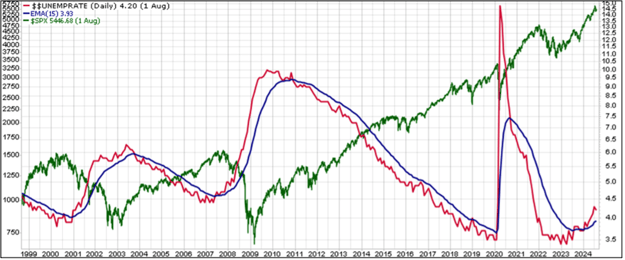

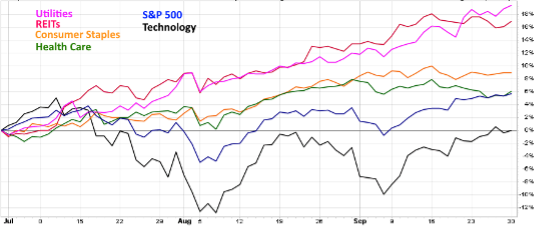

In addition, the unemployment rate is “quietly” trending higher, as shown in this next chart:

When the unemployment rate (red line) rises above its moving-average (blue line), indicating a trend change higher, the S&P 500 (green line) has tended to suffer thereafter.

I’ve discussed this next chart in past quarterly letters and it merits another mention.

The chart dates back to 1998 and it shows the yield curve (green dotted line) and the S&P 500 (red line). When the yield curve inverts, it is below the orange 0% line. Although yield curve inversions have a very good track record for predicting future economic recessions, it’s actually when the yield curve un-inverts or rises back above the orange line that has triggered sell-offs in stocks as the economy struggles. Note the blue arrow in the chart, depicting the yield curve likely bottoming and un-inverting or working its way higher.

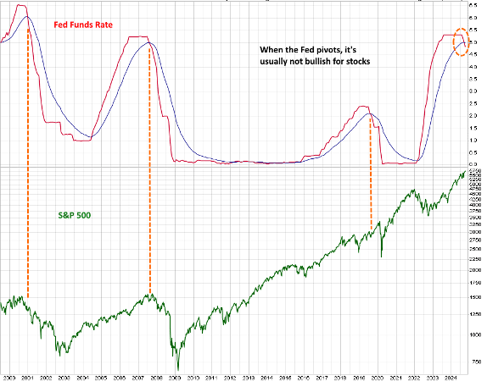

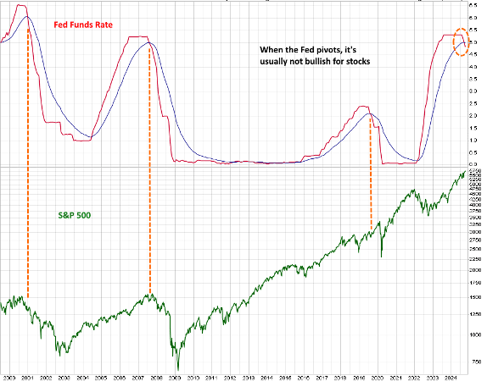

Finally, the following is another chart I’ve discussed in the recent past, it shows the fed funds rate (red line) and the S&P 500 (green line):

When the Fed eventually pivots and cuts rates, it has not been bullish for stocks (as denoted by the orange dashed lines). And with the 50 basis point cut in September, it appears the Fed has indeed pivoted with investors expecting several more rate cuts in the near future.

With respect to client portfolios, we remain defensively positioned as we are always being as mindful and vigilant about preserving capital as we are about striving to achieve significant relative gains. Given the discussion in this quarterly letter, we believe now is not the time to get overly aggressive.

As always, if you have any questions, please feel free to call or email.

The entire team at Measured Wealth wishes to thank you for entrusting us to deliver on your financial goals.

Edward Miller, CFA, CMT

Chief Investment Officer

Measured Wealth Private Client Group

Important Disclosures

Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns citied above are from various sources including Factset, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y-Charts, Inc. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

In order to provide effective management of your account, it is important that we have current information regarding your financial status and circumstances. Please contact us in writing at 303 Islington Street, Portsmouth, NH 03801 if you have any changes in your financial situation or investment objectives, and whether you wish to impose any reasonable restrictions on the management of the account or reasonably modify existing restrictions.

Measured Wealth Private Client Group, LLC is an investment adviser located in Portsmouth, New Hampshire. Measured Wealth Private Client Group, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Measured Wealth Private Client Group, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.

This publication is provided to clients and prospective clients of Measured Wealth Private Client Group, LLC for general informational and educational purposes only. It does not: (i) consider any person's individual needs, objectives, or circumstances; (ii) contain a recommendation, offer, or solicitation to buy or sell securities, or to enter into an agreement for investment advisory services; or (iii) constitute investment advice on which any person should or may rely. Past performance is no indication of future investment results. This publication is based on information obtained from third parties. While Measured Wealth Private Client Group, LLC seeks information from sources it believes to be reliable, Measured Wealth Private Client Group, LLC has not verified, and cannot guarantee the accuracy, timeliness, or completeness, of the third-party information used in preparing this publication. The third-party information and this publication are provided on an “as is” basis without warranty.

This publication may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “should,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio's operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Measured Wealth Private Client Group, LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.