By Edward Miller, CFA®, CMT®

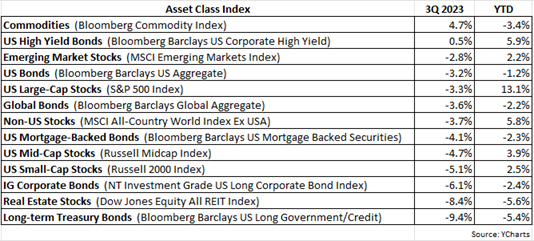

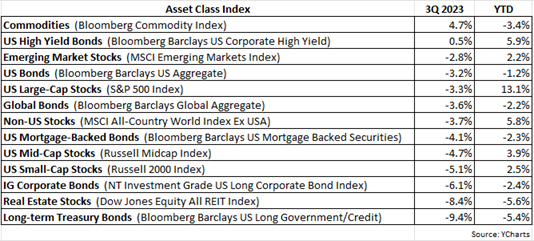

After both stocks and bonds posted robust returns in the first half of the year, with the 3Q came an abrupt halt to any further gains. The S&P 500 rose nearly 17% through the 2Q but declined by 3.3% in the 3Q. The Barclays US Aggregate Bond Index enjoyed a 2.3% gain through the 2Q but suffered a 3.2% loss in the 3Q. Most other major asset classes experienced negative returns in the 3Q, with commodities being the notable standout winner, posting a gain of nearly 5%.

Why the near-universal hemorrhaging of returns in the 3Q? The price of crude oil took off in the quarter, soaring by 29%, as overall inflation remained stubbornly elevated despite peaking and trending lower since late last year. In response, interest rates headed higher with the 10-year Treasury yield climbing from 3.9% at the end of the 2Q to nearly 5% in late September. When interest rates rise, bonds fall, but equity investors also became concerned that the Fed would maintain its hawkish stance on inflation, keeping interest rates relatively high and further draining liquidity from markets.

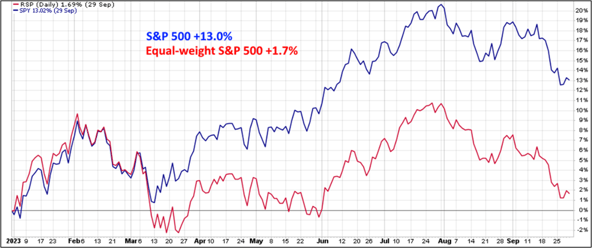

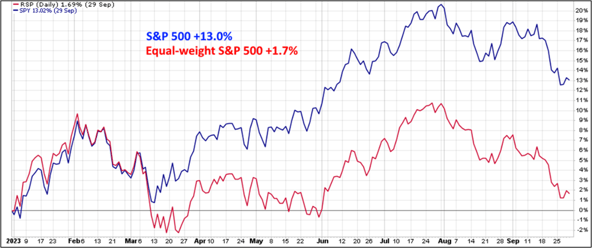

As discussed in my 2Q letter, the YTD positive performance of the S&P 500 can be attributed to just seven stocks: Apple, Microsoft, NVIDIA, Meta (Facebook), Amazon, Tesla and Alphabet (Google). In fact, through the 3Q, the average gain for these seven stocks was +88% compared to an average gain of just +2% for the remaining 493 stocks in the Index. The following chart further illustrates this staggering disparity in returns:

The S&P 500 Index is up 13% for the year through the 3Q, but the equal-weighted S&P 500 has risen by a meager 1.7% in that time. It’s fair to say that not owning these seven stocks has made it exceedingly difficult to outperform the S&P 500 this year.

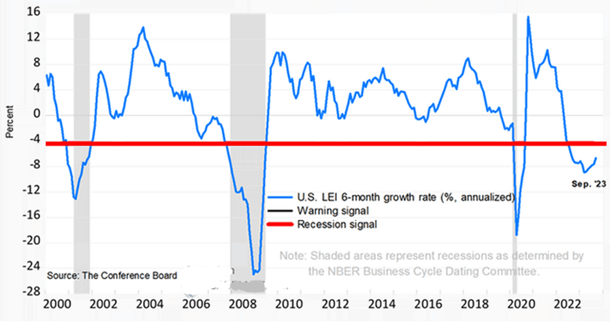

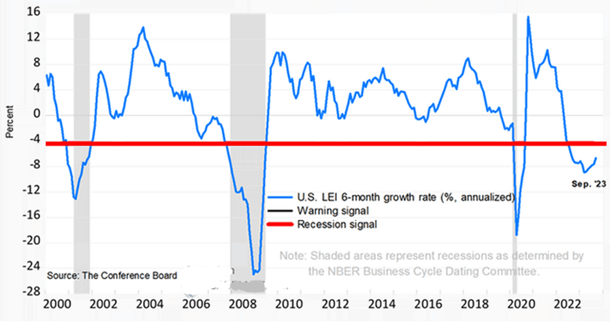

With respect to the seemingly long overdue economic recession, when will it finally arrive, if at all? It’s starting to become like the boy who cried wolf! As I’ve shown in prior quarterly investment letters, several proven indicators have been signaling a recession is forthcoming and imminent, and those indicators remain steadfastly bearish on the economy. For example, the following chart shows the 6-month growth rate of the Leading Economic Index (LEI):

When the LEI descends below 0%, and especially when below the red line, a recession has typically occurred (see grey shadings in chart). The LEI has been below the red line since last year and yet the US economy has remained very resilient, avoiding a recession despite the many negative indicators.

At this point, can we assume it’s different this time, that the indicators are wrong and we’ll avoid a recession? In my experience, the phrase “it’s different this time” is always proven wrong as it rarely if ever is different this time. Also, indicators calling for a recession have historically exhibited a lag effect, with eventual economic weakness materializing anywhere between one to 18 months later. The exact timing can vary depending on the confluence of factors and circumstances prevalent during each period.

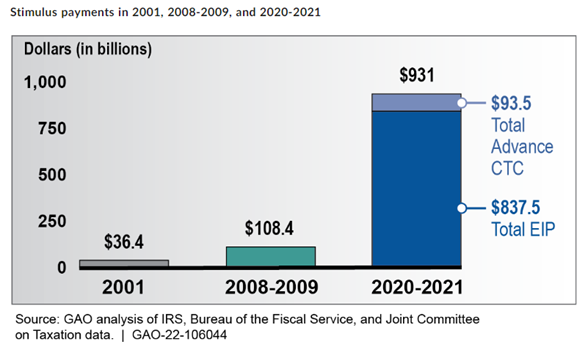

It's my contention that a primary reason for the long delay of this expected recession is due to the massive stimulus injected into the economy in response to the COVID-19 crisis of 2020. Approximately $5 trillion of federal aid went to individuals, businesses, and state & local governments. It was by far the largest federal aid outlay in US history. This enormous stimulus worked to shorten the pandemic recession then to just three months, the briefest on record. Although this government aid is now about three years old, given its size, it continues to bolster our economy as the ripple effects of such huge stimulus can sustain long after the initial outlay of money.

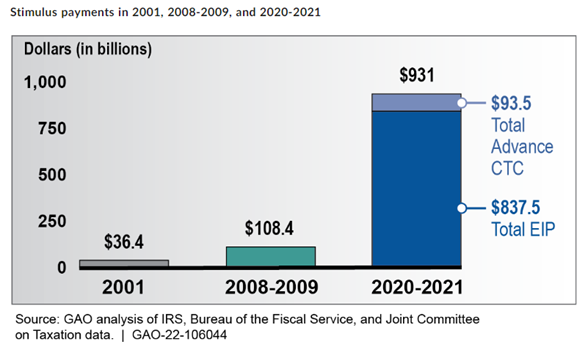

The following chart helps to put in perspective the magnitude of the COVID stimulus to individuals:

As shown above, post-COVID, individuals received nearly $1 trillion in direct payments from the government, as compared to much smaller figures during the Great Recession of 2008 and the recession of 2001.

Again, as a reminder, the federal government stopped issuing COVID-related aid in early 2021. In addition, since the start of 2022, interest rates have rocketed higher with the 10-year Treasury yield rising from 1.75% to nearly 5% in that time. In such a liquidity-draining environment, the existing stimulus – which arguably postponed the economic weakness we would’ve normally experienced – will eventually dry up and its beneficial impact will greatly diminish.

Of course, no one ever wants a recession, but when it comes to investing, it’s always best to remain clear-eyed and objective when assessing the macro environment and analyzing the data. As written in past quarterly letters, “Our client portfolios have been positioned defensively since late 2021 and have remained so to date.” Until we see more convincing indications that a recession is unlikely, we continue to err on the side of caution.

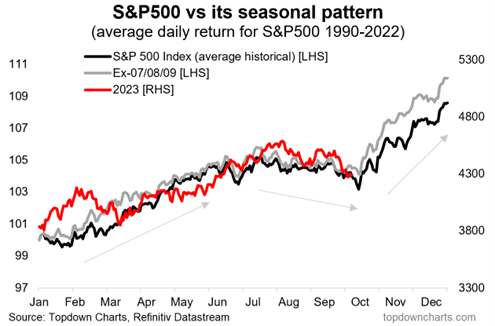

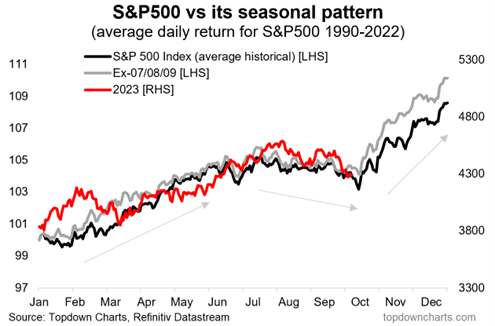

To close on a more uplifting note, seasonally the stock market is entering its most bullish period in the calendar year. As the following chart depicts, the S&P 500 rally this year (red line) did indeed confront some headwinds in the 3Q as was expected given the historical seasonal trend (grey & black lines). But once October comes along, equities tend to rise through December, often at an impressive rate.

As always, if you have any questions, please feel free to call or email. The entire team at Measured Wealth wishes to thank you for entrusting us to deliver on your financial goals.

Ed Miller, CFA, CMT

Chief Investment Officer

Measured Wealth Private Client Group

Important Disclosures

Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns citied above are from various sources including Factset, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y-Charts, Inc. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

In order to provide effective management of your account, it is important that we have current information regarding your financial status and circumstances. Please contact us in writing at 303 Islington Street, Portsmouth, NH 03801 if you have any changes in your financial situation or investment objectives, and whether you wish to impose any reasonable restrictions on the management of the account or reasonably modify existing restrictions.

Measured Wealth Private Client Group, LLC is an investment adviser located in Portsmouth, New Hampshire. Measured Wealth Private Client Group, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Measured Wealth Private Client Group, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.

This publication is provided to clients and prospective clients of Measured Wealth Private Client Group, LLC for general informational and educational purposes only. It does not: (i) consider any person's individual needs, objectives, or circumstances; (ii) contain a recommendation, offer, or solicitation to buy or sell securities, or to enter into an agreement for investment advisory services; or (iii) constitute investment advice on which any person should or may rely. Past performance is no indication of future investment results. This publication is based on information obtained from third parties. While Measured Wealth Private Client Group, LLC seeks information from sources it believes to be reliable, Measured Wealth Private Client Group, LLC has not verified, and cannot guarantee the accuracy, timeliness, or completeness, of the third-party information used in preparing this publication. The third-party information and this publication are provided on an “as is” basis without warranty.

This publication may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “should,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio's operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of Measured Wealth Private Client Group, LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.